The Trust is managed by Nick Purves and Ian lance of Redwheel , who have more than fifty years of investment experience between them and have been working as a partnership for over fifteen years.

The strategy employed by Temple Bar is known as value investing. This is the process of buying a company’s stock for less than its true worth (sometimes known as its intrinsic value).

By buying at a discount, this strategy builds in a ‘margin of safety’ and whilst in the short term an undervalued company’s share price might fall further, in the long run the built-in value should ultimately be recognised by other investors, prompting the share price to rise to reflect the stock’s intrinsic value. There is much empirical evidence to show that value strategies have delivered excess returns over the longer term.

Of course, some companies are cheap for a good reason, but we believe investments in good quality, yet undervalued companies with strong cash flows and robust balance sheets offer the best potential for attractive long-term investment returns.

It’s important to remember that there is no guarantee that a company’s valuation will move to reflect the value that the portfolio managers see. In addition, future and dividend growth is not guaranteed. As a result, the value of your shares in Temple Bar and the income from them can fall as well as rise and you may lose money. Further key risks we believe are faced by Temple Bar investors can be read here.

Find out more about our investment approach

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

A Classic Approach to Value Investing

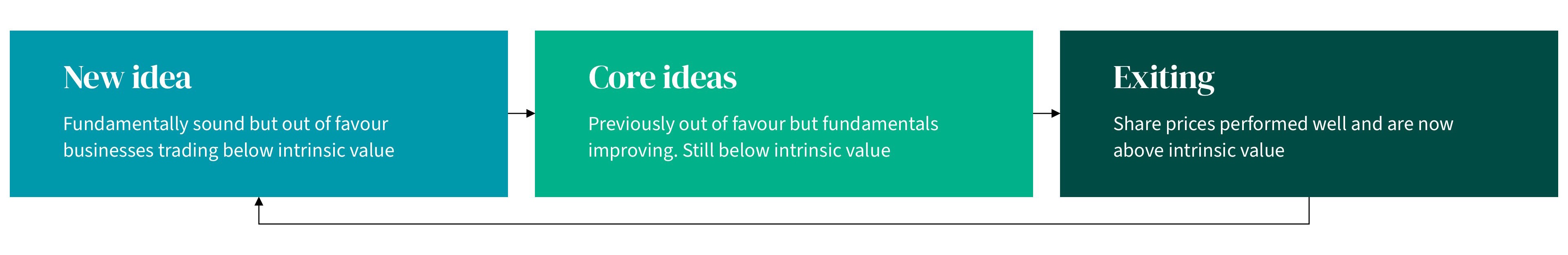

The portfolio managers Nick Purves and Ian Lance aim to rotate the Trust’s investment portfolio into those companies which they believe are available at a significant discount to intrinsic value. This involves buying the shares of attractively valued, out-of-favour companies and holding them for the long term until their share prices more appropriately reflect their true value, or until even more attractive ideas present themselves.

Typically, the portfolio can be broken down into three distinct categories:

Identifying Quality and Avoiding Value Traps

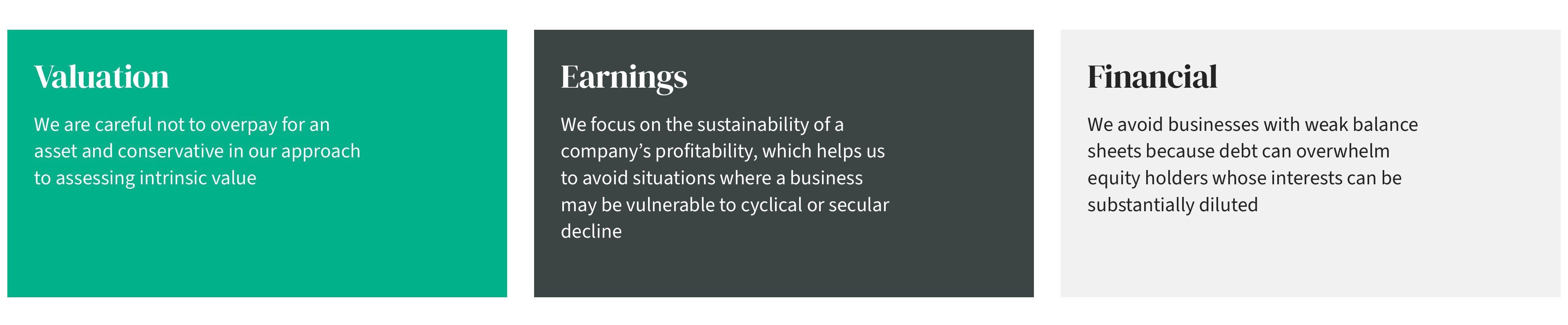

Some value strategies simply apply mechanistic measures to identify undervalued stocks but the problem with that is that it can lead an investor towards businesses that are in structural decline. These may be cheap for a reason, with limited potential for value to be realised.

In order to avoid these ‘value traps’, we aim to identify good quality companies that are undervalued. We place great emphasis on financial strength – strong cash flows and robust balance sheets – because it gives us the confidence that a company can survive through a prolonged period of lower profitability caused by company specific issues or an unexpected downturn in the economy.

We aim to avoid lower quality stocks or so called ‘value traps’ by monitoring companies against three different types of risk:

Past performance should not be taken as a guide to the future and dividend growth is not guaranteed. The value of your shares in Temple Bar and the income from them can fall as well as rise and you may lose money.

This Trust may not be appropriate for investors who plan to withdraw their money within the short to medium term. A portion (60%) of the Trust’s management and financing expenses are charged to its capital account rather than to its revenue account, which has the effect of increasing the Trust’s income (which may be taxable) whilst reducing its capital to an equivalent extent. This could constrain future capital and income growth. The effect of borrowings to finance the Trust’s investments is to magnify the volatility of its price and potential capital gains and losses. We recommend that you seek independent financial advice to ensure this Trust is suitable for your investment needs.

How to Invest

The Company’s shares are traded openly on the London Stock Exchange and can be purchased through a stock broker or other financial intermediary.