Ian Lance, Portfolio Manager

It is nearly five years since Nick Purves and I had the honour to be appointed as the new portfolio managers of the Temple Bar Investment Trust, and whilst we believe that the expression ‘pride comes before a fall’ is probably more true in asset management than almost any other walk of life, we think we can look back at what we have achieved with a sense of tempered satisfaction.

Some notable highlights since we were appointed at the end of October 2020:

-

A total share price return of 211%[1]

-

Number one in the UK Equity Income Sector per Citywire over 1, 2, 3 and 5 years[2]

-

Progressive dividend growth driven by both increasing revenues and the recent change of policy to supplement the dividend from capital

-

Discount closed over the period of our management to now trade at a modest premium

-

Market cap of £1bn reached for the first time on 23 September 2025[3]

Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

In this letter to our shareholders, therefore, we would like to look back at the last five years and highlight what we see as some of the most important lessons.

1. Value investing isn’t dead

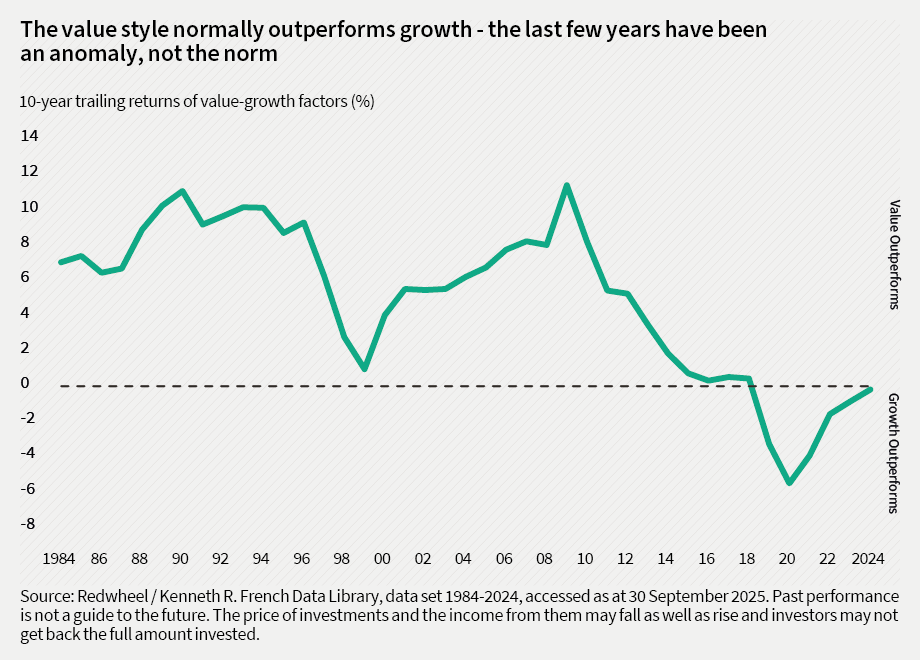

2020 was the end of a very unusual decade in which growth investing as a style had produced better returns than value. The chart below demonstrates just how rare this is.

This prompted some commentators to claim that value investing was dead. To us, this seemed an odd conclusion to draw. If you define value investing as an investment approach that seeks to buy businesses for significantly less than they are worth, how could that ever be dead?

“All intelligent investing is value investing — acquiring more than you are paying for. You must value the business in order to value the stock.”

Charlie Munger

“We think the very term 'value investing' is redundant. What is 'investing' if it is not the act of seeking value at least sufficient to justify the amount paid?”

Warren Buffett

2. Active fund management can add value

In recent years, active fund managers have had a tough time in general. Those focused on US equities have found it especially hard, with the index being powered upwards by the so-called Magnificent Seven stocks. This was seized upon by cheerleaders of passive investing as evidence that active investing no longer worked. Whilst, on average, this is perhaps a fair assessment, one should always be wary of conclusions based around averages – as the six-foot tall man who drowned crossing a river that was five feet deep on average found out to his cost. Our experience, and that of Temple Bar’s shareholders, suggests that the disciplined application of a value investment strategy can still produce returns in excess of the wider market in the long run.

3. You can make good returns in UK equities

The UK equity market was written off for not having enough exposure to exciting technology stocks and, latterly, because of the anti-business, anti-growth economic policies of the current government. And yet, the 211% total return from Temple Bar over the period of our management has been significantly in excess of the 112% from the US stock market despite the fact the latter benefited from the returns of the Magnificent Seven stocks[4]. It is always worth remembering that a country’s economy is not the same as its stock market. Encouragingly for Temple Bar shareholders, the UK market continues to languish at one of the lowest valuations seen over the last fifty years whilst the US is, on some measures, more expensive than it has ever been.

4. It is the volatility that creates the opportunities…

Without a shadow of a doubt, the strong returns that Temple Bar shareholders have enjoyed over the last five years are a function of the start point. It is easy to forget the level of fear that existed at the start of the pandemic, but this is perhaps best illustrated by the fact that the share price of NatWest in 2020 was at the same level as in the depths of the Global Financial Crisis in 2008, when the government nationalised its predecessor Royal Bank of Scotland[5]. It is this extreme level of fear that sometimes causes investors to make emotional, possibly irrational decisions, but provides opportunities for those able to tame their emotions, go contrary to the crowd and think long term.

“It is largely the fluctuations which throw up the bargains and the uncertainty due to the fluctuations which prevents other people from taking advantage of them.”

John Maynard Keynes

5. No company is so good that it can’t be turned into a bad investment by paying too high a price for it

In the years following the Global Financial Crisis, it is fair to say that there were some very high-quality companies trading at valuations which did not adequately reflect their strengths. Investors in our open-ended funds will know that we owned shares in Microsoft in 2010 because it was an unpopular business at that time and hence could be bought for eight times its earnings, which seemed to represent good value to us. Ten years later, however, many businesses like Microsoft had rerated to valuations which were so high that they virtually guaranteed poor returns.

“There's no such thing as a good idea or bad idea in the investment world. It's a good idea at a price, it's a bad idea at a price. Whenever we consider an investment, we think just as much or more about what can go wrong as about what can go right, and we put the avoidance of losses on a high pedestal.”

Howard Marks

6. It is foolish to put a line through a sector and declare it ‘uninvestable’

One of the key contributors to the returns Temple Bar shareholders have enjoyed has been its investments in the UK, with perhaps NatWest being the standout performer having risen by 440% in the last five years[6]. One of the reasons returns have been so good is that the fundamentals have been very strong with earnings per share going from 25p in 2021 to an estimated 61p in 2025[7]. The key factor, however, was that the sector was utterly loathed five years ago with some investors declaring it ‘uninvestable at any valuation’. Thus, you were being offered the opportunity to buy businesses at very low valuations just at a time that their fundamentals were set to dramatically improve – almost the perfect investment opportunity.

7. We benefit from the increasing number of investors for whom valuation is irrelevant

We continue to believe that starting valuation is one of the best guides to long-term returns and that if you buy a stock at a significant discount to intrinsic value, not only do you have a margin of safety built in to your investment, but over time you should gain an excess return as the controversy declines and the share price moves towards intrinsic value. Interestingly, however, fewer and fewer investors seem to use valuation as part of their investment process. According to some estimates, passive funds now account for almost half of the equity market and obviously take no account of valuation (arguably they allocate more of their money to the larger, often more expensive stocks in the index)[8]. The growth of multi-strategy funds (or pod shops) has had a similar effect since these ‘investors’ are very short term and have no regard for valuation. We believe that, in the long term, this puts investors like us, for whom valuation is the cornerstone of a disciplined process, at an advantage, since it should lead to more securities being mispriced in the stock market.

8. Don’t be too quick to take a profit

Temple Bar’s shareholders would not have enjoyed such strong returns if we had been too quick to take a profit. As time has gone on, we are increasingly convinced that inactivity is a blessing and that you should run your winners. When a struggling business begins to improve, the effect will often last for years and investors are often repeatedly surprised at how positive operational gearing feeds through to profit growth. As a share price responds to an improving trend in profits, momentum investors who wouldn’t look at the company when it was available at, say, five times earnings may feel compelled to invest in it at a much higher valuation. Hence, the share price often goes far further than we may have initially thought. Both NatWest and Marks and Spencer, for example, have exceeded our initial expectations in recent years in terms of earnings growth and multiple expansion – we have allowed both positions to run higher in the portfolio, keen not to take a profit too early.

9. The investment trust structure is a good one especially for the retail investor

Temple Bar is nearly one hundred years old and there are those who argue that the investment trust structure is antiquated and no longer fit for purpose. Our experience of the last five years would suggest exactly the opposite. Whilst liquidity means that the largest wealth managers cannot move around the market using investment trusts as vehicles, for the smaller shareholder, they have significant advantages. Truly independent and strong Boards such as Temple Bar’s work in the best interests of their shareholders, as evidenced recently with the enhancement of the dividend using the capital account to reflect the shift by UK companies from paying dividends towards share buybacks. Finally, returns have been enhanced through the disciplined use of gearing.

10. Boards have the ability to add (or destroy) significant value particularly at inflection points

None of this would have happened if the board had capitulated to the wisdom of the crowds in 2020 and proposed to switch the style of the trust from value to growth. With the benefit of hindsight this seems an obvious decision, but the board did not have this benefit and moreover several other trusts switched style at exactly that time. Shareholders owe an enormous debt of gratitude to the current and former board members who took the brave decision to stick with value investing when many others were throwing in the towel.

Looking forward

In closing, we would note that the stock market is always intriguing, but the events of the last five years have perhaps made this period one of the most fascinating of our careers. We would like to thank the board for their support throughout this period and you, our shareholders, for putting your faith in us. What excites us both as we reflect on our five years as portfolio managers for Temple Bar is that we strongly believe that this journey is far from over. On many measures, today’s Temple Bar portfolio looks as attractive as it has done throughout our tenure, and for that reason, we look forward to the next five years… at least!

[1] Source: Bloomberg from 30 October 2020 to 30 September 2025 on a share price total return basis in UK sterling.

[2] Source: Citywire to 30 September 2025 on a NAV total return basis in UK sterling

[3] Source: Bloomberg as at 23 September 2025

[4] Source: Bloomberg from 30 October 2020 to 30 September 2025 on a total return basis in UK sterling

[5] Source: Bloomberg

[6] Source: Bloomberg from 30 October 2020 to 30 September 2025 on a total return basis in UK sterling

[7] Source: Bloomberg as at 10 October 2025

[8] Source: Morningstar, March 2025

Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. Information contained in this document should not be viewed as indicative of future results. The value of investments can go down as well as up.

This article is issued by RWC Asset Management LLP (Redwheel), in its capacity as the appointed portfolio manager to the Temple Bar Investment Trust Plc. Redwheel is authorised and regulated by the UK Financial Conduct Authority and the US Securities and Exchange Commission.

The statements and opinions expressed in this article are those of the author as of the date of publication.

Redwheel may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. Redwheel seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by Redwheel are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by Redwheel; or (iv) an offer to enter into any other transaction whatsoever (each a Transaction). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party. Redwheel bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction.

How to Invest

The Company’s shares are traded openly on the London Stock Exchange and can be purchased through a stock broker or other financial intermediary.