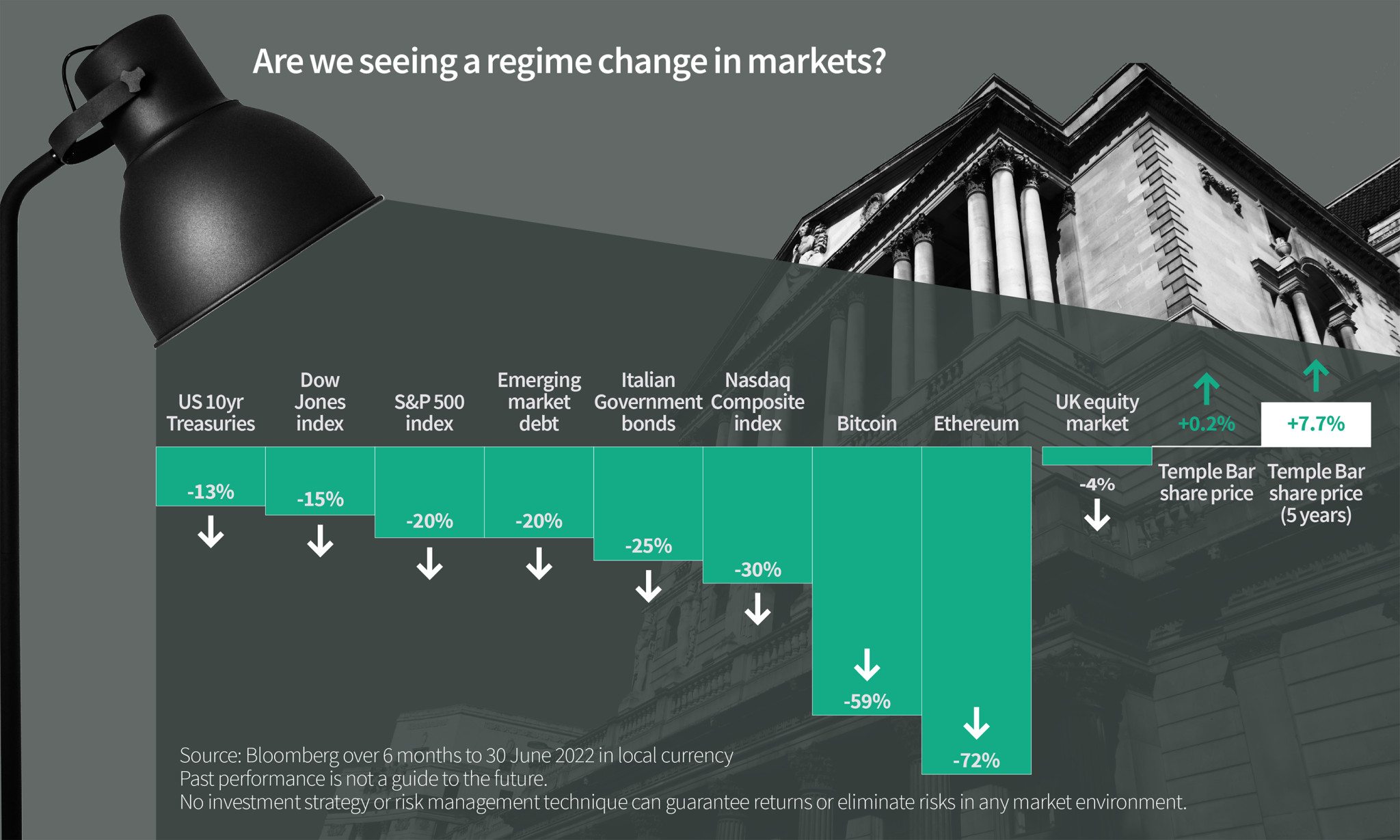

It is an understatement to say that the first half of 2022 was a torrid time for most investors. The first half of 2022 has been the worst period for stock markets in more than 50 years and fears over rising interest rates and the potential recessions they will bring, have seen many other investment assets suffer so far this year.

The S&P 500 fell just over 20% in the first six months of 2022[1], its worst half-year performance since 1970. The Dow Jones is down 15%, while the technology heavy Nasdaq index performed even worse, losing just over 30%, its biggest half-year loss ever.

At the same time, 10-year US Treasury bonds – the benchmark of global borrowing markets and traditional go-to asset in troubled times – have had their worst first half since 1788. Treasuries have lost more than 13%, the most since the U.S. constitution was ratified, according to Deutsche Bank; Italy’s bonds have haemorrhaged 25% in preparation for the European Central Bank’s first interest rate hike in over a decade; and emerging market debt is down nearly 20%.

Cryptocurrencies, which were previously lauded as being non-correlated to equities, were terrible in the main as Bitcoin fell 59% in the first half of the year – that is the worst start to a year ever for the cryptocurrency (worse even than the 58% drop in 2017). Ethereum was worse, falling 72% YTD.

Amongst this carnage, the UK equity market fared much better and although the total return was negative at -4%, this was relatively good when compared to the asset classes highlighted above. It is pleasing to report that the Temple Bar share price was significantly more defensive in the first half, producing a modestly positive total return of 0.2%.

What is going on?

The simple truth is that the extreme monetary and fiscal stimulus applied by central banks and governments during the pandemic created one of the greatest bubbles in asset prices ever witnessed. The 1,200% rise in the price of Tesla and Bitcoin in the twelve months between March 2020 and March 2021 were just two of numerous examples of the speculative fervour which gripped investors during this period and pushed prices of many assets far above their fundamental value. In a recent white paper[2] from Jeremy Grantham, one of the founders of US asset manager GMO, he states “for the first time in the US we have simultaneous bubbles across all major asset classes”. This presents an enormous challenge for many investors who have become accustomed to diversifying into bonds as protection against a deflating bubble in equities. That option is not available in the current context, because bonds are in what Grantham describes as a ‘superbubble’ defined as any asset class which has moved three standard deviations above its long-term trend.

These policies have also contributed to a rise in the rate of inflation and, having spent the last year claiming that this was only transitory, central banks have finally acknowledged that this is clearly not the case. Policymakers are now urgently reversing the stimulus in order to try to cool the inflationary pressures. US interest rates are currently set for a range of 1.5% – 1.75% and will almost certainly be at 2% in the coming months given inflation is currently above 9%. Both the increase in inflation and the accompanying increase in interest rates are bad news for asset prices because such conditions typically cause equities to de-rate and bond yields to rise.

Every cloud has a silver lining

However, although the overall impact on equity markets may be negative, not all stocks will be affected equally by this rise in interest rates. The stocks that have benefited most from the prolonged period of ultra-low interest rates look considerably more vulnerable to what is unfolding. This in large part explains the significant dispersion in returns between growth-oriented parts of the market like Nasdaq, and pockets of value such as the UK market. It is worth recalling that the collapse of the dotcom bubble in 2000 occurred at the same time that value stocks produced one of their best periods of return in both absolute and relative terms. We believe that current conditions suggest that the recent rally in value stocks may have only just begun. The charts below should help to explain why.

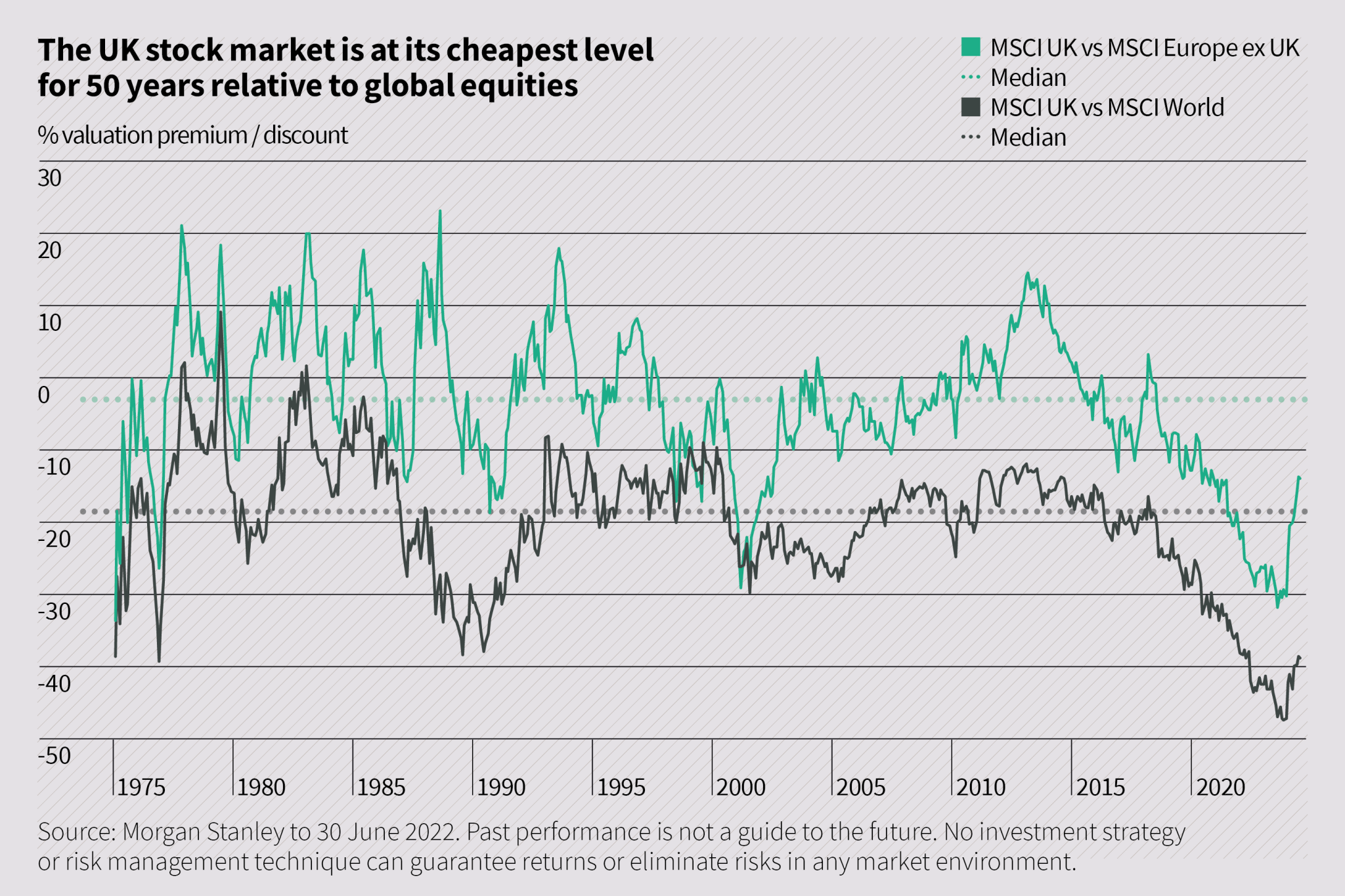

1. The UK is one of the cheapest major global stock markets

Whilst equities look expensive in most parts of the world, one exception is the UK. As the chart below shows, despite the better performance year to date, the UK equity market is still at its cheapest level relative to the MSCI World index for nearly fifty years. This should make it an attractive place to invest for anyone concerned about the likely de-rating of equities elsewhere.

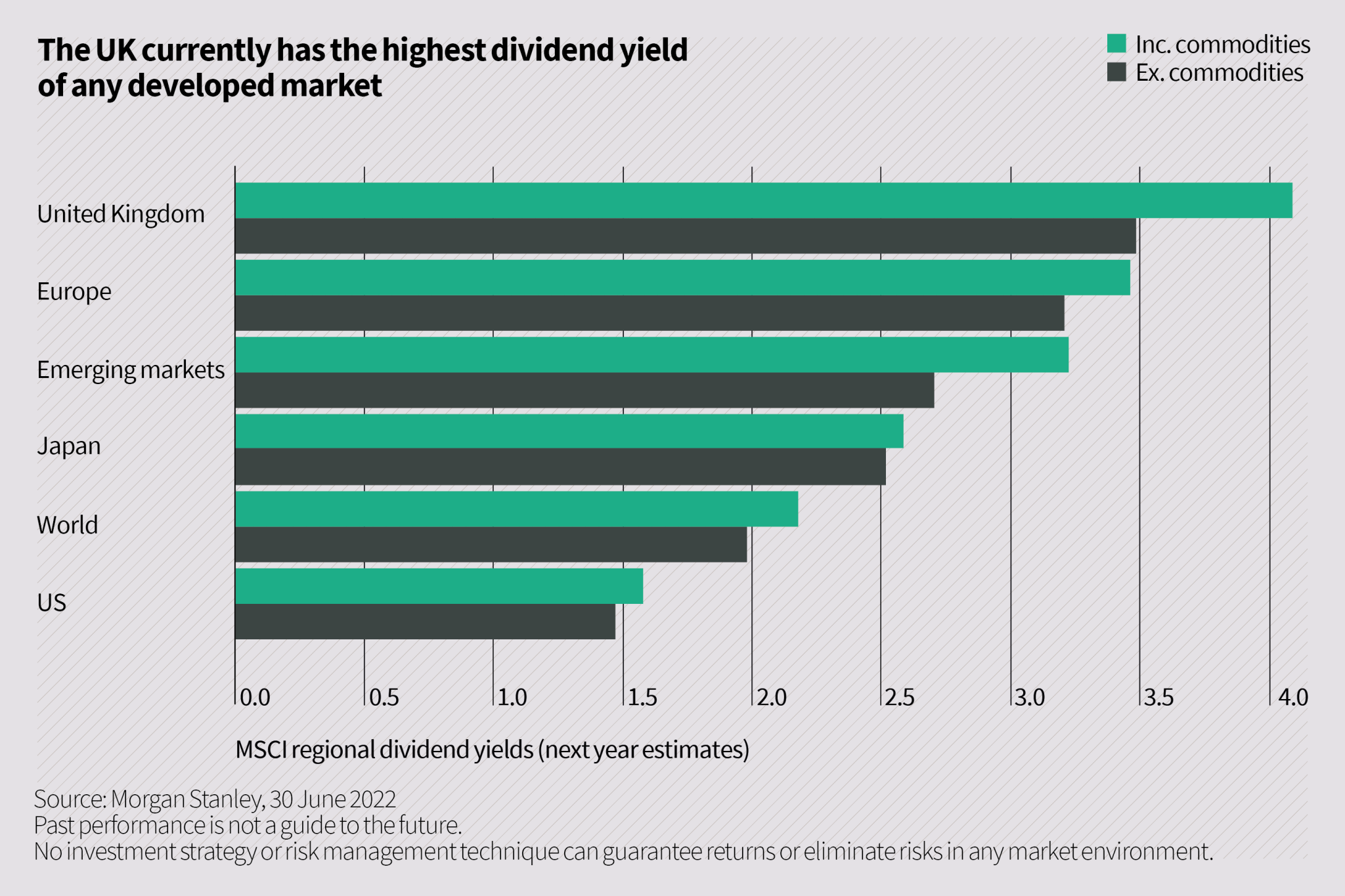

2. The UK offers one of the highest dividend yields

For a number of years, investors have grown used to seeing healthy capital gains from their equity portfolio and this has reduced the need to produce an income as investors could sell part of their capital to generate income. If investors can no longer rely on predictable capital gains from their equity portfolio, then dividend income may once again become important. The UK offers a clear advantage here as it currently has the highest dividend yield of any developed market.

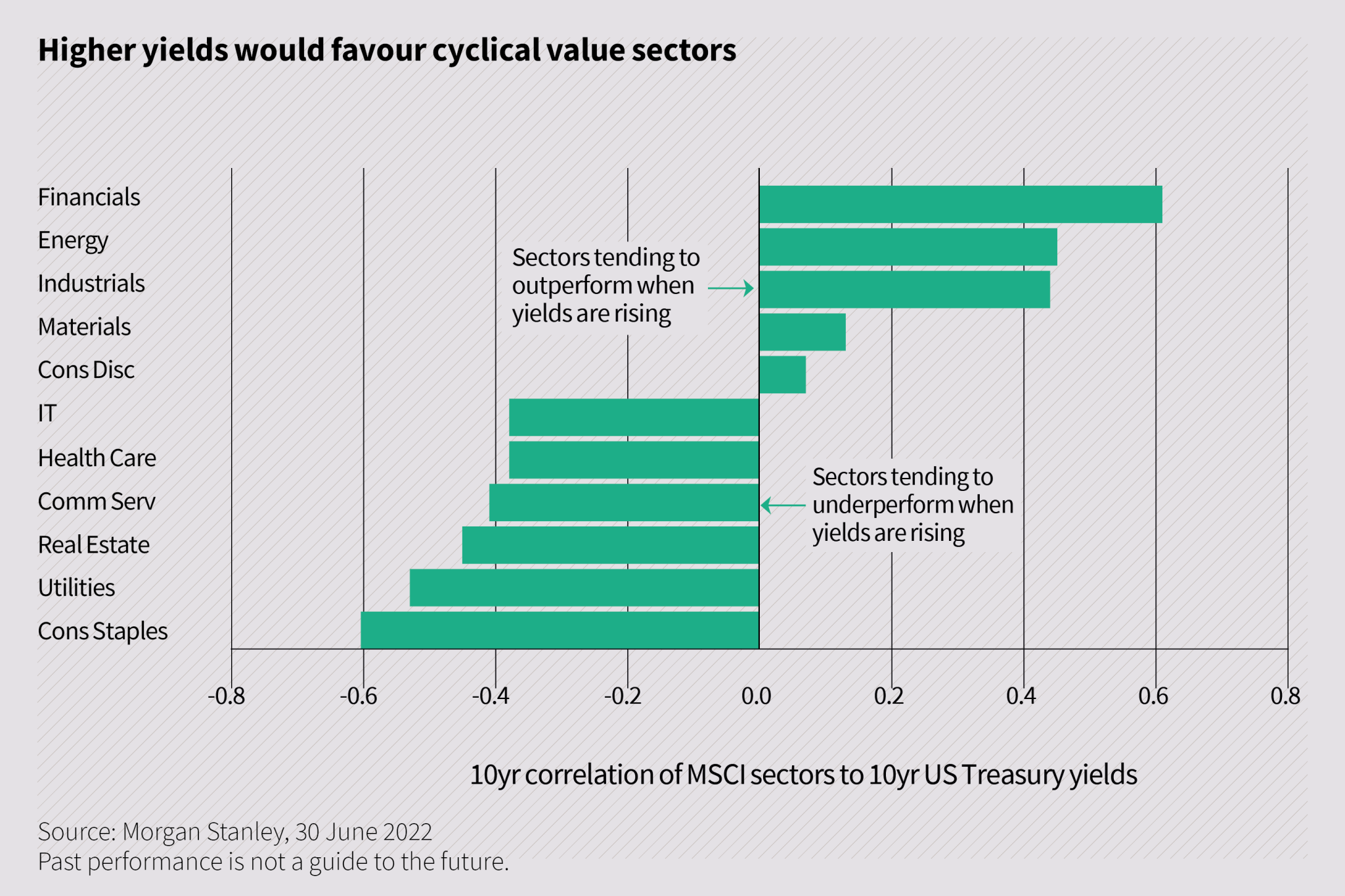

3. The UK has a large weighting to the sectors which historically do well as interest rates rise

During the bull market in technology stocks, many investors shunned the UK as it had very little representation to the sector. The change in the monetary backdrop has created a regime change in which the best performing sectors have been energy and mining, to which the UK has high exposure. As the NASDAQ index continues its collapse, the UK’s low exposure to the technology sector has become a positive attribute.

4. Low valuations

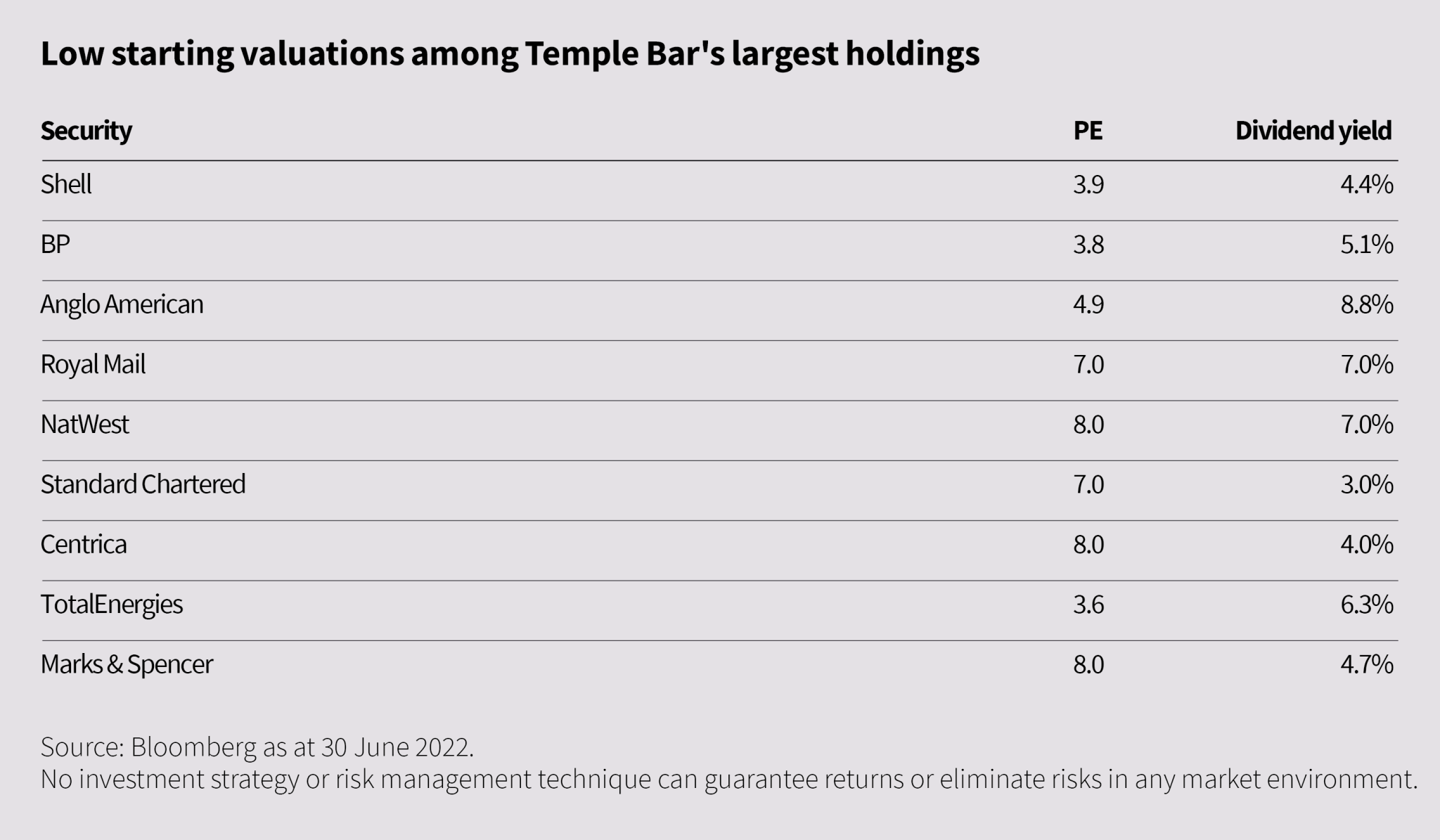

The valuations of many of the trust’s largest holdings are amongst the lowest that we have witnessed in our entire investing career (some examples are shown in the table below). Although this is no guarantee of success, historically low starting valuations have been highly correlated with strong subsequent returns.

Conclusion

It is no longer contentious to say that the macroeconomic conditions that produced the decade long bull market in growth stocks have changed, as inflation has reappeared and interest rates have risen in response to it. This has produced a regime change in which the winners of the last few years, led by technology stocks, have become the losers in the last twelve months. Conversely, the old economy sectors that were shunned through this period such as energy, mining and industrials have produced the some of the greatest returns over the last year and yet still look very lowly valued.

Such were the excesses that occurred during the final stage of the bubble, we find it very unlikely that these will correct in twelve months. Indeed, it seems more likely to us that this is just the start of a multi-year period of returns for value stocks which should be of long-term benefit to the holdings in the trust.

The first half of 2022 has been a tough period across asset classes, and we acknowledge that these are uncomfortable times for investors. But, for the reasons we’ve outlined, this ‘annus horribilis’[3] could turn into an ‘optimum tempus’[4] for long-term shareholders.

Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. Information contained in this document should not be viewed as indicative of future results. The value of investments can go down as well as up.

This document is issued by RWC Asset Management LLP (Redwheel), in its capacity as the appointed portfolio manager to the Temple Bar Investment Trust Plc. Redwheel, is authorised and regulated by the UK Financial Conduct Authority and the US Securities and Exchange Commission.

Redwheel may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. Redwheel seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by Redwheel are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by Redwheel; or (iv) an offer to enter into any other transaction whatsoever (each a Transaction). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party. Redwheel bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction.

[1] All data in this section is sourced from Bloomberg, covering the six months to 30 June 2022, in local currency. Past performance is not a guide to the future.

[2]Let the Wild Rumpus Begin by Jeremy Grantham, GMO, 20 Jan 2022

[3] A Latin phrase roughly translated to ‘horrible year’

[4] A Latin phrase roughly translated to ‘excellent period’

How to Invest

The Company’s shares are traded openly on the London Stock Exchange and can be purchased through a stock broker or other financial intermediary.