The asset management industry can tend to concentrate on short-term performance, with fund managers’ returns frequently measured over a month, a week or even a day. Positive short-run returns are often used as evidence that a fund manager is ‘skilful’ and are extrapolated into the future. The same can be true of poor short-term returns which are attributed to bad judgement rather than bad luck. In this article, we suggest that, at best, short-run returns have very little real meaning, and at worst, they may contribute to the buy high, sell low mentality prevalent in some parts of the investment industry.

Short circuit

When asked whether they want their fund manager to slavishly follow the crowd or to take a contrarian view, I suspect most investors would opt for the latter. They fail to realise, however, that whilst having a portfolio that is different from an index guarantees different results to that index, there is no guarantee that performance will be better over every time period.

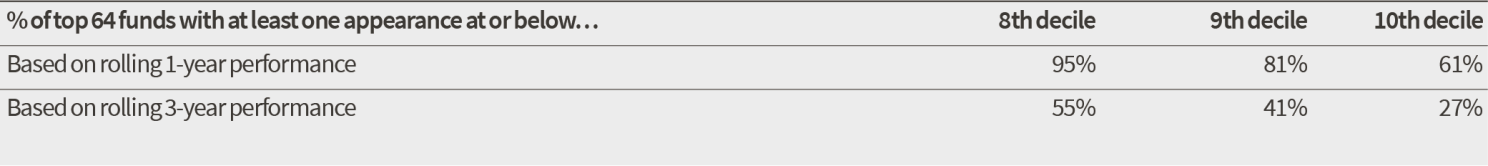

A study by the Brandes Institute set out to examine this subject[1]. It identified the top performing decile of US portfolio managers in the period from 1999 to 2009, which gave a group of 64 funds, all of which had beaten the S&P 500 index by at least 4.6% per annum across the full period.

It then looked at the profile of returns of this group of funds within the period. When it studied the worst one-year rolling returns versus the benchmark, it found that the average was -22.4%, with the worst being -40.5%. The average of the worst three-year rolling periods was -8.3%, with the bottom being -17.8%.

These results seem simply staggering – in a world where being a couple of percentage points behind the benchmark is sometimes enough to get a fund manager fired, some of these managers had been 40% behind the index and still went on to be among the best performing funds over ten years!

The Brandes Institute then went on to look at the performance of this top 10% of fund managers relative to their wider peer group over shorter time periods. Again, the results were illuminating. Of the group of 64 best performing fund managers, on a one-year time scale, 61 had been in the 8th decile or lower at some stage in the ten years. On a three-year time scale, 35 of the fund managers (more than half) had been in the 8th decile or below at some point during the period.

Rome wasn’t built in a day

Source: Brandes Institute, 2009

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

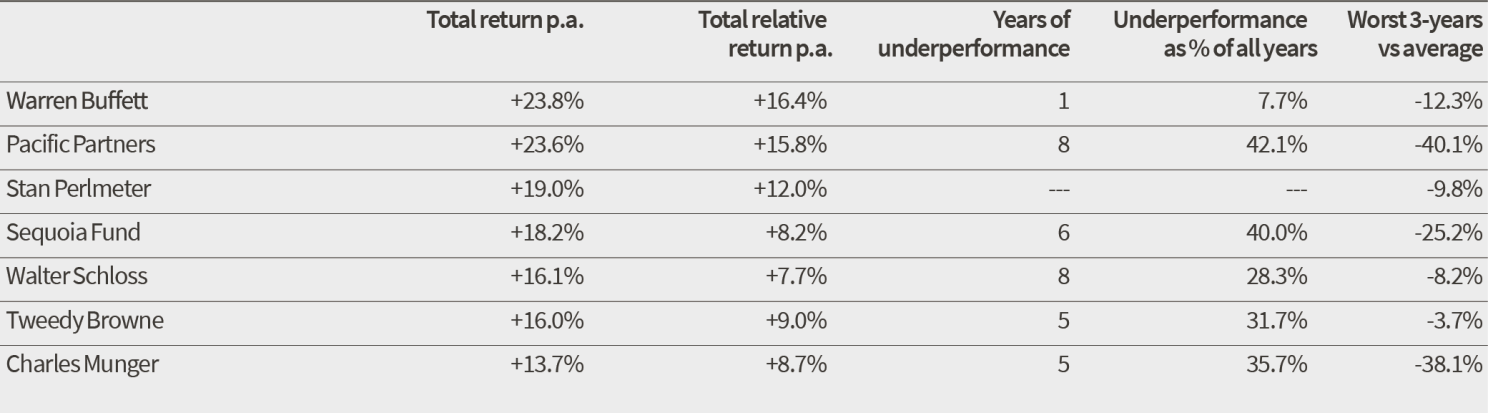

The magnificent seven

A similar pattern of performance can be observed by examining the track records of seven fund managers identified by Warren Buffett in his 1984 speech and accompanying article entitled ‘The Superinvestors of Graham and Doddsville’. Buffett highlighted the magnificent returns these fund managers had delivered by following the value investing principles of Ben Graham. However, in 1986, Eugene Shahan looked at the shorter-term pattern of returns of these fund managers in a study which demonstrated how all of these superinvestors had periods of short-term performance that were much worse than the market, and yet still went on to produce spectacular long-term returns[2].

Patterns of performance by the Superinvestors

Source: The hare and the tortoise revisited, 1986

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

Again, it is worth highlighting the frequency and magnitude of this short-term underperformance. All of the investors other than Buffett had underperformed in 25-45% of the years studied with one investor registering a return 40% behind the index over three years. Despite this, that manager, Pacific Partners, went on to deliver 23% per annum, beating the index by 16% per annum.

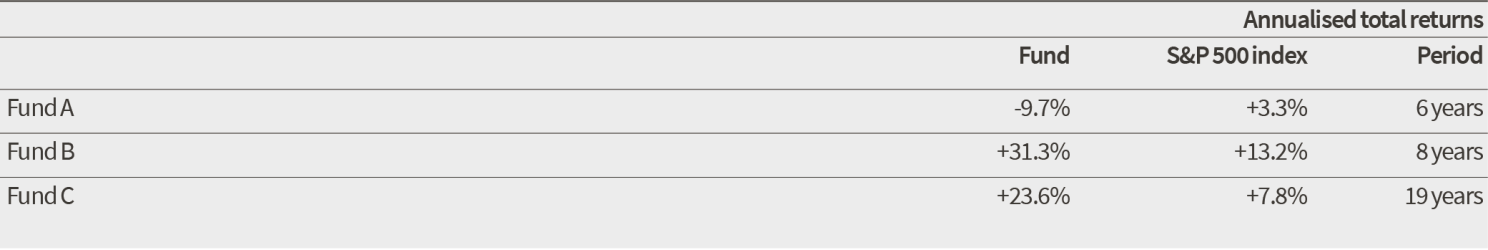

If this is not enough to make us question the significance of looking at short-term returns, consider the results below. Which of these managers would you hire, and which would you fire?

Hire or fire?

Source: The hare and the tortoise revisited, 1986

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

My guess is that few people would have patience with Fund A, which had trailed the market by a jaw dropping 13% per annum over six years. Many investors would have fired the manager – probably long before the sixth year – and replaced it with Fund C.

The twist here is that they are all the same fund manager – Pacific Funds – viewed over different time periods. Those who fired Manager A would have missed out on the returns generated in period B (the returns that followed period A) and period C (the returns delivered over the full duration).

Yet again, the conclusion seems to be that short-run performance tells us relatively little about the likelihood of long-term success.

Long hello and short goodbye

Although many investors appear to desire great long-run returns with no volatility, these studies suggest this is an unrealistic ambition. In fact, investors should be surprised if a manager never encountered a period of underperformance, because we know that in the short-term, share price movements are largely driven by sentiment. Thus, for a manager to never encounter short-term underperformance, he/she would need to have the ability to correctly anticipate changes in market sentiment and position his/her portfolio accordingly in advance and without moving share prices. Alternatively, when a contrarian manager buys an out of favour stock, how likely is it that sentiment towards it changes immediately after they buy it?

Unfortunately, this tendency to extrapolate short-term returns into the future is one of investment’s most harmful characteristics. Investing relies on a mixture of skill and luck, but the shorter the time frame you examine, the more likely it is that luck rather than skill will have influenced the results.

Meanwhile, fund performance tends to be mean-reverting, which means that by picking a manager with good short-term results, you are increasing your chances of long-run returns being average or worse. In 2005, Professors Goyal and Wahal analysed 3,400 pension plans and endowments over a ten-year period and found that they tended to appoint funds that had performed well in the recent past and fire those with poor short-term performance[3]. When they tracked performance in subsequent years, they found that many of the managers that had been fired went on to beat those that had been hired.

How can investors get around this? Firstly, they must recognise that a greater sample size leads to more meaningful conclusions. In practice, this means looking at the longest periods of performance data possible and paying little regard to short-term noise.

Secondly, investors should focus on process as well as outcome. For example, does a fund manager have an intellectually robust process that he/she has applied in a disciplined fashion over a number of years and that has worked in the long run? If so, it is highly likely that short-term underperformance will improve at some stage in the future.

Until fund management companies and investors stop focusing on short-term results, however, there is a disincentive for most fund managers to take a long-term contrarian view. The career risk involved with doing so is just too high. Yet it is only by acting in this way that they are likely to produce returns that are superior to the index and peer group.

“It is the long-term investor, he who most promotes the public interest, who will in practice come in for the most criticism… For it is the essence of his behaviour that he should be eccentric, unconventional and rash in the eyes of average opinion. If he is successful, that will only confirm the general belief in his rashness; and if in the short run he is unsuccessful, which is very likely, he will not receive much mercy.”

John Maynard Keynes

Conclusion

Every time I read a classic investing book like ‘The Intelligent Investor’ or ‘The Margin of Safety’ I am struck by the fact that the basis of successful investment is a) simple and b) has not changed for decades. What is staggering is how many investors seem to make life so difficult for themselves by ignoring the investment strategies that have worked for decades. In fact, the opening line of Margin of Safety is as follows:

“Investors adopt many different approaches that offer little or no real prospect of long-term success and considerable chance of substantial economic loss. Many are not coherent investment programs at all but instead resemble speculation or outright gambling.”

Seth Klarman

Successful investing is rarely ever about guessing which company might beat the whisper number next quarter or trying to speculate on where the copper price might be in six months. It is simply about buying assets for less than they are worth, holding them for the long term and being rewarded either through the income they generate, the move back towards intrinsic value or both. These are the simple steps which, if followed in a disciplined fashion, significantly tilt the odds in an investor’s favour. Indeed, they are the simple steps that we employ on behalf of Temple Bar shareholders.

Yours sincerely

Ian Lance, Nick Purves

[1] ‘Death, taxes and short-term underperformance’, Brandes Institute, 2009

[2] ‘Are short-term performance and value investing mutually exclusive? The hare and the tortoise revisited’, Eugene Shahan, 1986

[3] ‘The selection and termination of investment managers by plan sponsors’, Goyal and Wahal, 2005

Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. Information contained in this document should not be viewed as indicative of future results. The value of investments can go down as well as up.

This document is issued by RWC Asset Management LLP ( RWC ), in its capacity as the appointed portfolio manager to the Temple Bar Investment Trust Plc. RWC, is authorised and regulated by the UK Financial Conduct Authority and the US Securities and Exchange Commission.

RWC may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. RWC seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by RWC are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by RWC; or (iv) an offer to enter into any other transaction whatsoever (each a Transaction). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party. RWC bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction.

How to Invest

The Company’s shares are traded openly on the London Stock Exchange and can be purchased through a stock broker or other financial intermediary.