Ian Lance and Nick Purves of Redwheel, were appointed to manage the Temple Bar Investment Trust portfolio in November 2020. In this first quarterly letter to investors, they explain some of the long-standing principles that lie behind their approach to investment, and why we may now be seeing a renaissance of the value style, leaving the Trust well positioned to potentially deliver outsized rewards for its shareholders in the years to come. This letter reflects the views of the Managers as will be the case with all subsequent editions.

Ian Lance and Nick Purves of RWC Partners, were appointed to manage the Temple Bar Investment Trust portfolio in November 2020. In this first quarterly letter to investors, they explain some of the long-standing principles that lie behind their approach to investment, and why we may now be seeing a renaissance of the value style, leaving the Trust well positioned to potentially deliver outsized rewards for its shareholders in the years to come. This letter reflects the views of the Managers as will be the case with all subsequent editions.

To Shareholders of the Temple Bar Investment Trust Plc

We should start by saying how honoured we feel that RWC has been appointed as the new investment manager for such a prestigious Trust, at what we believe is a challenging yet exciting time for value-oriented investors. One of our objectives is to communicate with you, the shareholders of the Trust, in an open and transparent way, in the hope that this will foster faith in us as stewards of your capital. Probably one of the most important things needed for a value strategy to be a success is having an appropriate investor base i.e. those with a long-term orientation and a focus on process over outcome. We, therefore, believe that regularly writing to our investors will help you to understand our thought processes, what we have been doing and why.

We intend to write to you on a quarterly basis on a variety of topics that we hope you will find both interesting and useful and that it will give you an insight into our investment philosophy. As this is the first time of writing, we thought it appropriate to set out our core beliefs as value investors.

- Value investing is simply the act of attempting to buy shares in a business for less than their true worth or ‘intrinsic value’. Estimating the intrinsic value of a business and thereby identifying when its share price is at a significant discount should be relatively simple. The more difficult part is having the mental fortitude to go against the crowd since shares typically only trade at discounts to intrinsic value during periods of stock market dislocation or when a business is suffering a setback. Value investing is sometimes described as ‘simple but not easy’: simple because there is nothing inherently complicated about it; not easy because it requires the emotional discipline to invest almost always in the face of bad news.

- We are value investors because we believe that it is a strategy that works and there is a huge amount of empirical evidence to prove this. The reason we believe it works is because human beings are subject to behavioural biases that mean that they are prone to overreaction and extrapolation. When a company or industry is doing badly, investors often struggle to see a future in which conditions can improve and thus discount the prospect of a permanent state of decay. The reality is that given time, most companies can adapt to a new competitive landscape and through a combination of re-orientation, cost reduction and the retiring of capital, that company’s fortunes improve. This means therefore that share prices overshoot underlying intrinsic values in both directions thus creating investment opportunities for long term investors with a contrarian mindset. We try to put ourselves at a fundamental advantage by thinking and acting longer term than most market participants and thus exploiting their extrapolation and over-reaction.

- Much has changed in the last thirty years such as the availability of huge amounts of information, algorithmic trading and centrally planned financial markets. Human nature, however, is the same as it always has been. The forces of fear and greed, hindsight bias and loss aversion are still there, and they still cause the over-reactions which provide opportunities for the contrarian investor. If you are clear what you are looking for and disciplined in its application, then volatility is your friend. Whilst some commentators have recently suggested that ‘value investing is dead’, this strikes us as unlikely unless you believe that human beings have learnt to conquer their emotions. We do not see any signs of this.

- The market has recently become fixated with ‘quality’ and ‘value’ in the context of stock selection. This is nonsense to us as quality refers to the attributes of the business whilst value refers to the price being paid. We like to buy high-quality businesses, we just object to paying too much for them. Remember that if the future turns out as you expected, but that has already been priced in by the consensus, you might not make any money. A company might be high quality and with fabulous growth prospects but if the market can also see that, it is probably priced in. Now ask yourself what happens if that company disappoints that cheery consensus. No-one would dispute that Microsoft has been a fabulously successful business but if you had bought it in 2000, you would have had to wait sixteen years to get your money back simply because you over-paid for it on day one. This is simply because its valuation was so high at the peak of the dotcom bubble that not even its high growth rate could prevent its share price from declining by more than two-thirds between 2000 and 2009. It did not regain its prior peak until 2016. History has shown that starting valuations are inversely correlated with subsequent returns and we continue to believe this will be the case in the future.

- Whilst stock market volatility of the type we saw last year can feel extremely uncomfortable, investors should not lose sight of the fact that a share provides its owner with a claim on a long stream of corporate cash flows, stretching 20 to 30 years into the future and that therefore a relatively short period of depressed profitability resulting from an economic downturn does not significantly alter the value of the share. This is provided, of course, that the company’s profitability is not permanently impaired. Often, therefore, extreme declines in share prices, of the sort that we saw at the beginning of last year, are an overreaction by fearful investors. This provides those with a longer-term timeframe and a focus on a company’s profit potential once the crisis has passed, with the opportunity to purchase shares in sound businesses at a very meaningful discount to their true worth. It’s become a cliché to say that one should be fearful when others are greedy and greedy when others are fearful, but it is true nevertheless and we are confident that we were able to take advantage of last year’s dislocation for the considerable long-term benefit of the Trust. Bargains in the stock market are rare so it’s important to make the most of them when they appear.

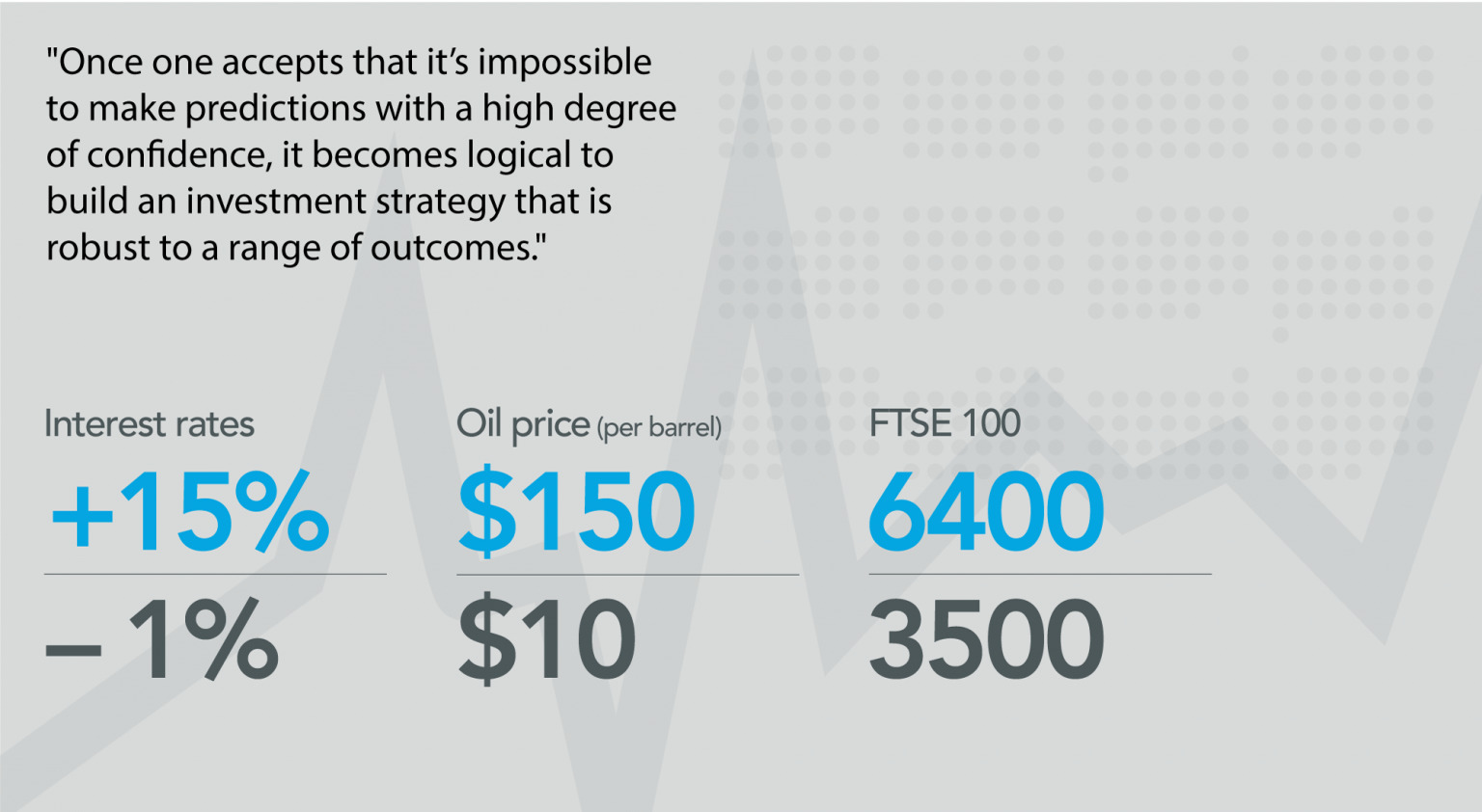

- We acknowledge how unpredictable the future is and we don’t waste large amounts of time trying to forecast the unforecastable (who in 2019 would have forecast a global pandemic in the following year?). This will seem strange since most in our industry spend their time confidently making predictions about the future. One rarely hears a fund manager say “I really don’t know” in reply to a question on his outlook or admit that his recent outperformance was down to a) luck or b) the waxing and waning of investment styles. Former US Treasury Secretary, Robert Rubin, once said: “Some people are more certain about everything than I have ever been about anything” and that is exactly how we feel after thirty years in fund management. We have seen interest rates at +15% and -1%, the oil price at $10 and $150 and the FTSE 100 at 6400 and 3500 in the same twelve-month period*. Many things that we felt sure would happen have not come to pass and there have been things that have occurred that we never could have predicted (central bankers printing money to buy equities, for example, and fund managers buying negatively yielding bonds). Once one accepts that it’s impossible to make predictions with a high degree of confidence, it becomes logical to build an investment strategy that is robust to a range of outcomes.

- Because corporate profits are inherently volatile, it can be very misleading to value companies based on one year’s earnings, as those earnings may be unsustainably high or unusually depressed. We therefore stress the importance of valuing businesses off a conservative view of their longer-term profit potential, thereby adjusting for the effect of the economic cycle. We ask ourselves:

- What level of profits can a company generate in a reasonable year?

- Are its finances sound, thereby allowing it to survive a severe economic downturn without requiring additional equity?

- Finally, does the company have a sustainable future and can it thereby create value for shareholders whilst simultaneously protecting the interests of all its stakeholders?

* Source: Bloomberg. Interest rate and oil price data illustrate the extremes seen over the last 30 years. FTSE 100 data

refers to price movements between May 2008 and March 2009.

- If a company’s shares can be bought at a multiple of eight to ten times its ‘normal’ earnings potential and the answers to the other questions are “yes”, then we are minded to invest. Such was the level of fear in the stock market in the early part of last year that many companies were available at multiples of just five to six times earnings. Such shares offered the potential for over 100% returns over a very reasonable timeframe and we were active in trying to take advantage of those opportunities where they arose.

- Many value investors proudly boast that they “completely ignore the macro” and in some ways that makes sense. Getting the timing and direction of inflation, currencies, interest rates etc is hard enough without then trying to fit a portfolio of stocks around that view. Companies’ profits and share prices are, however, impacted by cycles (credit, commodity, and business) and it is investors’ overreaction to these cycles that throws up opportunities. It is crucial, therefore, to recognise that cycles exist and to gain an understanding where we currently are in those cycles.

- Whilst recognising that investors are subject to bias, we think it’s important to maintain a healthy respect for the markets as they represent the collective wisdom of a large number of people. The collective wisdom of the crowd can sometimes understand the implications of certain events far more quickly than we can as individuals. We must however not let the markets become our master, for there can also be a collective loss of sense when herd mentality takes over. Understanding when the market is being rational and when it is being irrational is something that cannot be learnt in a book but is rather gained from experience.

- We are wary of leverage in all its forms and believe that too much debt can be fatal. Nearly all our worst investments have involved companies where a decline in profitability combined with a vulnerable balance sheet. A company must have finances that are strong enough to see it through a sudden downturn in the economy. Last year was a good illustration of this.

- We view risk not as volatility in share prices that can be captured in a single number but instead as the threat of a permanent impairment of capital. We have already mentioned valuation risk (paying too much for a company) and balance sheet risk (equity investors being diluted down or wiped out by a company carrying too much debt when business conditions deteriorate). To this we would add earnings risk (buying a company at the top of a business cycle shortly before its earnings decline) and sustainability. The latter point can refer to a company whose business practices damage its reputation and/or earnings potential but it can also include an industry which is in secular decline and where profits are therefore unsustainable. This issue of sustainability is enormously important and hence we intend to devote a future letter to explain our approach to Environmental, Social and Governance issues and how it differs from those investors who simply exclude certain industries.

- We recognise that we live in a time of huge technological change, and that many industries are being permanently disrupted with the result that many will never return to an acceptable level of profitability. We work hard therefore to differentiate between those companies where an adverse change in customer behaviour has left the asset fundamentally impaired with the shares lowly valued for a good reason, and those which offer sustainable value because, despite the fact that they operate in challenging and competitive markets, they remain relevant to their customers.

- Performance over short periods of time is driven by luck and is therefore meaningless when it comes to evaluating a fund manager and yet plenty of people will place great weight on it. This is human nature and there is therefore little that can be done to change this mind-set.

- We are not afraid to do nothing. We work in an industry where a high level of dealing activity is somehow taken as a sign of confidence and ability. Doing nothing is sometimes the hardest thing to do but frequently the best.

Many commentators have been quick to write the obituary of value investing. This capitulation has previously marked the bottom of the value cycle and we believe this could be the case today. We see no reason why the principles that we have highlighted above should suddenly cease working after decades of success since they are built on exploiting behavioural biases that have existed for centuries. Moreover, we believe that current conditions are like those post the technology bubble of 1999/2000 and the global financial crisis of 2008 which preceded periods of strong returns from value strategies. On both occasions, there was an extreme dislocation in the markets, with some areas looking very overpriced, whilst other areas offered significant value. On each of these occasions, we were able to take advantage of the dislocation to purchase sound business at bargain prices, thereby setting our clients up for several years of strong excess returns. We are at the same juncture today and whilst the future is always inherently uncertain and the path will be uneven, we believe that after a difficult 2020, the Trust is well positioned to potentially deliver outsized rewards for its shareholders in the years to come.

Yours sincerely,

Ian Lance, Nick Purves

This letter is being sent by Temple Bar Investment Trust PLC (the “Company”) to its shareholders (and is not addressed to or otherwise being sent by the Company to any other parties) and as such is not (by virtue of Article 43 of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005) a financial promotion for the purposes of the Financial Services and Markets Act 2000.

References herein to RWC Asset Management LLP or “RWC” are in respect of its capacity as the appointed portfolio manager to the Temple Bar Investment Trust Plc. RWC, is authorised and regulated by the UK Financial Conduct Authority and the US Securities and Exchange Commission. RWC may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document.

This letter is not intended to be an offer or solicitation of an offer to buy or sell securities in the Company. Furthermore, this letter does not constitute investment advice or an investment recommendation. Whilst reasonable care has been taken in the preparation of this letter, no responsibility or liability is accepted (by the Company or RWC) for the accuracy or completeness of the information contained in this letter including the opinions expressed by the Company and/or RWC.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Please note that the value of investments and the income derived from them may fall and you may get back less than you originally invested. Past performance is not necessarily a guide to future performance and information contained in this document should not be viewed as indicative of future results. Before making any investment decision you are strongly advised to consult your own professional investment or other adviser.

How to Invest

The Company’s shares are traded openly on the London Stock Exchange and can be purchased through a stock broker or other financial intermediary.